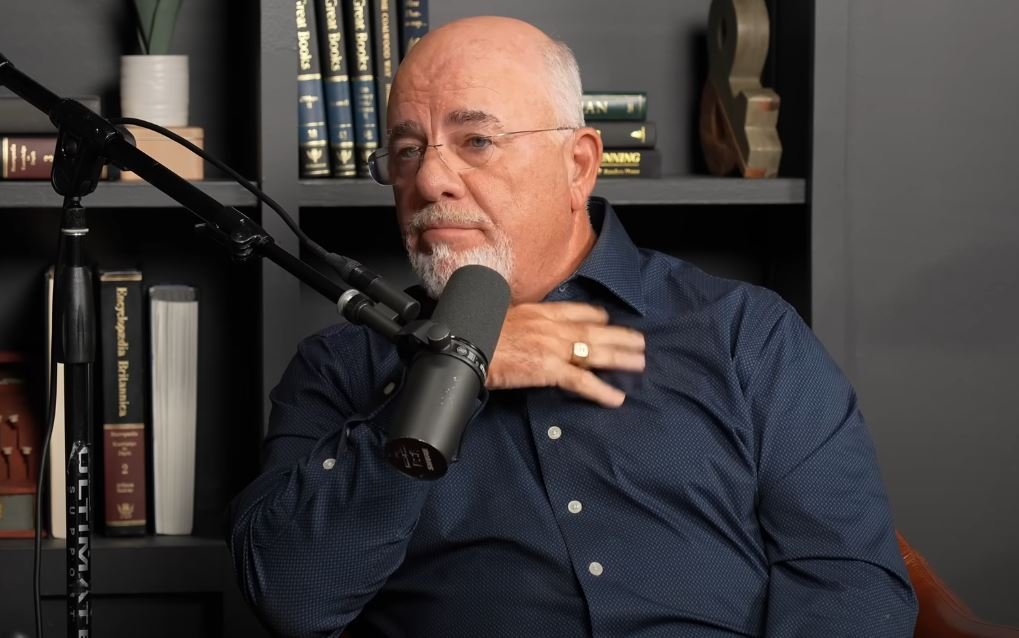

In the same way that he encourages millions to follow his “baby steps,” Dave Ramsey’s $200 million fortune has been accumulated piece by piece. His net worth is a particularly potent illustration of wealth attained via discipline, brand clarity, and an unwavering commitment to living debt-free, even though it is not yet close to billionaire status. It’s not ostentatious, but it’s purposefully constructed, which is what gives it resonance.

Ramsey had amassed a real estate portfolio worth more than $4 million by the time he was 26 years old. He had accomplished something that many people strive for decades. However, his financial empire started to fall apart when the Tax Reform Act of 1986 altered the lending environment. He declared bankruptcy when he was 28. Even though it was financially disastrous, that moment signaled the beginning of an amazing financial philosophy. One based on biblical values, cash-only transactions, and the profoundly human realization that financial strain can destroy not just bank accounts but also mental health.

Dave Ramsey – Personal and Financial Overview

| Attribute | Details |

|---|---|

| Full Name | David Lawrence Ramsey III |

| Date of Birth | September 3, 1960 |

| Age | 64 years |

| Nationality | American |

| Occupation | Financial Author, Radio Host, Entrepreneur |

| Education | University of Tennessee (Finance and Real Estate) |

| Net Worth (2025) | $200 Million |

| Business Ventures | Ramsey Solutions, The Ramsey Show, Financial Peace University |

| Notable Books | The Total Money Makeover, Financial Peace |

| Spouse | Sharon Ramsey |

| Children | Denise, Rachel, and Daniel |

| Primary Residence | College Grove, Tennessee |

Ramsey established the Lampo Group, which is now Ramsey Solutions, through a calculated act of reinvention. The company became extremely successful at packaging advice, publishing best-selling books, and creating courses that caused a financial awakening across the country. He exemplified financial literacy rather than merely advocating for it.

His approach, which focuses on behavior rather than mathematical optimization, is frequently criticized by scholars for ignoring specific macroeconomic principles. One well-known example is the “debt snowball” strategy, which emphasizes paying off the smallest debts first. Although it isn’t the fastest path in terms of math, it has been especially helpful for those who have trouble staying consistent. Ramsey recognized that many people view money more emotionally than rationally.

Through the use of relatable stories, live call-in advice, and church-based teaching, he was able to craft a financial movement that was particularly appealing to middle-class households. Ramsey Solutions’ expansion in recent years, which was achieved without the help of investors or debt, has made his business model incredibly dependable during periods of market volatility. He was able to maintain his audience’s trust and avoid financial compromise by controlling his media and content.

Ramsey has made extensive use of his real estate convictions over the last ten years. In Tennessee, he has bought and sold a number of multimillion-dollar residences. Most famously, he sold a custom-built mansion in Franklin for $10.2 million. Later, he paid $3.75 million in cash for a 7,000-square-foot estate in College Grove. His ability to walk the walk with almost mathematical accuracy is demonstrated by these actions, which highlight his extraordinary consistency.

Ramsey’s investment portfolio, which is primarily composed of mutual funds, shuns well-liked speculative fads like day trading and cryptocurrency. His dedication to long-term, conservative investments has made his financial record remarkably resilient, especially in uncertain economic times. He continued to advocate for individual accountability throughout the pandemic, opposing stimulus checks and encouraging followers to prioritize habits over handouts.

He has received praise and criticism for that position. He is sometimes referred to as tone-deaf, particularly during national emergencies. What is evident, though, is that Ramsey is remarkably genuine; he doesn’t change with the times or fashions. He leads with the same passion, the same stories, and the same conviction that anyone who puts in the effort can achieve financial peace.

Millions of people have heard his teachings. With over 600 radio stations carrying the Ramsey Show, it continues to be a very effective tool for building his brand. Along with co-authoring books and emerging as a reliable voice in financial literacy, his daughter Rachel Cruze has also taken center stage. This change in the company’s generational makeup demonstrates how Ramsey has thoughtfully laid the groundwork for the future.

His empire has been shadowed in recent years by lawsuits and controversies. Debate was sparked by a $150 million lawsuit involving a failed advertiser. Concerns were also raised by allegations regarding the company’s culture, which included stringent lifestyle regulations. However, Ramsey’s financial engine has continued to grow in spite of these criticisms. If anything, it has served as a reminder to both detractors and supporters that even role models make mistakes and that openness is more crucial than perfection.

Ramsey’s system is still very flexible for a large number of Americans, particularly those who have little access to individualized financial planning. It can be used when preparing for retirement, college, or difficult financial times. Even his detractors agree that his frameworks, despite their simplicity, are intentionally made to be sustainable and actionable.

His steady voice on the radio encouraged people to take a moment to plan, budget, and pause during the pandemic, when panic buying, debt accumulation, and financial instability were all too common. Ramsey continues to influence discussions that are frequently overlooked by the media by fusing traditional discipline with contemporary communication.

His message will probably not go out of style in the years to come. His simple advice to cut the card, budget every dollar, and build slowly may seem surprisingly affordable as younger generations struggle with student loans, rising rent, and lifestyle inflation.